Council has first public budget hearing

Paso Robles City Council meeting June 7, 2016.

Goals include returning services to pre-recession levels

–On Tuesday, June 7 the Paso Robles City Council held its first public hearing on the proposed two-year Operating and Capital Improvement Budget. The budget has been developed for each fund and makes use of reserves, bond proceeds and grant funds as well as current revenues. The budget, including feedback, will be brought back to council for adoption on June 21.

The proposed document includes the financial years, 2016‐17 and 2017-18. It addresses all city programs and funds, with emphasis on the general fund, the road maintenance and repair efforts associated with the half‐cent sales tax approved by the voters in 2012; and the city’s four enterprise funds; water, sewer, airport, and transit. For the past several years the city has been focused on recovery from the recession, according to the report. The goal is to return services to their pre‐recession levels. During the next few years, the city is more likely to face a new recession than fully recover from the last one. The budget considers the existing, reduced level of services as the baseline, or the “new normal.”

Paso Robles City Manager Thomas Frutchey said this process was his first with this council; city staff want to make sure the document reflects the council’s requests and direction. “This is the baseline budget, it is basically a budget that we are doing to date, there are some changes,” he said. “The city has through prudent fiscal management developed reserves for emergencies which hopefully we will never have to face. We have provided options for some of those reserves to be brought back into the community. This is a great community and we need to make advancements across all fronts.” The city still faces grave financial challenges, he said. “Those challenges restrict what we can do. Even so, this budget includes many new initiatives. Others are still being developed for later presentation to council, once they have been fully developed.”

Frutchey said every year there are revenues and expenditures, and that the city can end with a deficit which means the expenditures were greater than the revenues. “The council would then direct staff to take money from reserves,” he said. “The reserves are like a savings account for the city. Reserves allow us to meet our financial obligations on a month to month basis. Most months of the year the expenditures are higher than the revenues. The surplus is what is available at the end of the year, if we achieve budget surplus meaning our revenue was higher than our expenditure for the year, the surplus will go straight into our reserves savings fund.”

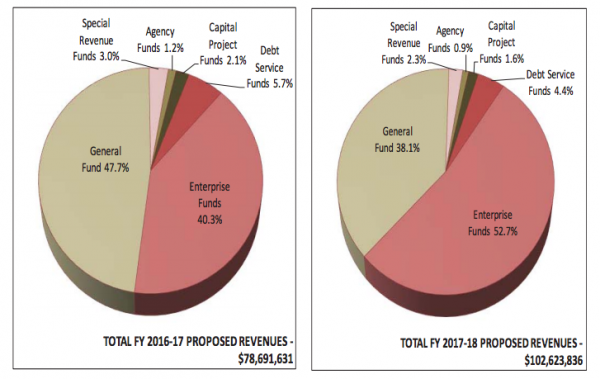

Proposed revenues for the Paso Robles City funds.

General Fund

Revenues and transfers (exclusive of grants) accruing to the general fund are projected to remain steady at $36.9 million in 2016‐17. The city’s primary revenue sources, property taxes, sales taxes, and transient occupancy taxes, are projected to remain strong, growing over the next year from $30.2 million to $31.4 million, a four percent increase. This increase is offset primarily by a $1 million decrease in miscellaneous one‐time revenues/transfers from other funds (including Gas Tax and Redevelopment Funds) due to state actions. General fund expenditures (exclusive of grant‐funded projects) for the baseline budget are projected to slow in 2016‐17 by 5.5 percent from the current year, decreasing from $36.7 million to $34.9 million, primarily due to a decrease in already programmed capital expenditures. Both revenues and expenditures in the baseline budget are projected to grow in 2017‐18. Including grants, the general fund is projected to have net revenues of $0.3 million in the current budget year, $2 million in 2016‐17, and $3.1 million in 2017‐18, assuming the baseline budget. If reserves are used for major infrastructure projects (such as replacing the Sherwood Park Restrooms) these projected net revenues are sufficient to provide for the service options and capital expenditures recommended for council approval in the proposed budget.

Road Maintenance and Repair

This is a general city responsibility, paid for by Gas Tax receipts and general fund monies. The approval of a half‐cent sales tax measure in 2012 provides in excess of $4 million in additional resources each year to assist the city in maintaining its most expensive physical asset. For the first few years of the measure the city has moved cautiously, programming no more than $4 million in road repair expenses over and above its maintenance of effort. However, there are so many lane miles in need of extensive repair that this budget proposes to accelerate those efforts. The total increment will not exceed the value of resources generated by the sales tax measure through its 12‐year life; the projects in any given year, however, may exceed the resources generated in that year. A full list of proposed projects, augmenting those approved previously, is included for council’s review and approval.

Enterprise Funds

As a result of recently adopted rate increases, the financial health of the water fund is projected to stabilize during the next two years. This stabilization will allow the funding of some system improvements, including replacing mains that are nearing the end of their useful life, and replacing the 90‐year old 21st Street Reservoir. The overall health of the water fund would be significantly damaged, however, if the pending voter initiative qualifies for the ballot and receives the affirmative vote of a majority of those voting.

Sewer Fund

The sewer fund has stable rates, with no increases needed for several years, based on an in‐depth analysis conducted as part of a recent rate study. The completion of the $42 million treatment plant project using State Revolving Fund loans has put the city in a good position to move forward with a major project that will initiate tertiary treatment and recycled water in the next five years. Staff are actively working to secure Proposition 1 grants and State Revolving Fund loans for these efforts. Like the Water Fund, the Sewer Fund will also be doing substantial replacement of aging pipes and pumps throughout the next two years.

Airport Fund

The Airport Fund is continuing to be stable, based primarily on revenues from leases. Federal Aviation Administration (FAA) grants help the airport to complete needed capital projects for aeronautics; a large grant is projected in 2017‐18. The airport fund will start setting aside funding for depreciation during the budget period, and using that funding to complete capital and maintenance work that is not eligible for FAA funding.

Transit Fund

The transit fund is also projected to remain relatively stable during the two years of the budget period.

To view the complete financial report, click here.

Comments

The news staff of the Paso Robles Daily News wrote or edited this story from local contributors and press releases. The news staff can be reached at info@pasoroblesdailynews.com.