Paso Robles homes become less affordable

As home prices and mortgage rates rise, buyers are squeezed

Home prices up nearly 15 percent in the last year

Interest rates jump 25 percent

Housing affordability falls

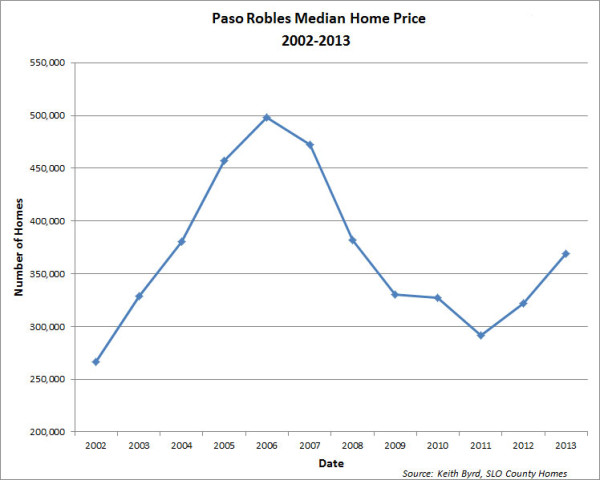

Through September of 2011, the median sales price for a single-family home in Paso Robles dipped to $291,444. This was the lowest nine-month median since 2002, a 41.5% drop from the 2006 September average of $498,500. At that point, the real estate recovery had not been going particularly well.

The summer buying season of 2011 was hijacked by drama over possible European and U.S. government debt defaults. Markets were jumpy and consumers were nervous.

Columnist Rylan Stewart

Since then, the housing market has enjoyed significant progress, logging double-digit price gains between 2012 and 2013.

Prompted by record low mortgage rates, dropping with the help of the Federal Reserve’s quantitative easing programs, improved economic outlook, and favorable prices, buyers jumped back into the market, turning the 2012 and 2013 real estate seasons into buying frenzies. Single-family buyers and investors competed side-by-side.

“It seemed like every house under 400k was getting multiple offers and going over list price, if not list,” said realtor Dianna Vonderheide of Mercari Group, Inc., speaking of North County homes.

“Values in the North County went down much more after the bubble, compared to San Luis Obispo, so there was much more room to make up.”

Median price for homes in Paso Robles over the last 10 years.

From its 2011, the median price for a single-family home sale rose to $322,000 through September of 2012 and had hit $369,000 by September of 2013. All statistics are compiled from MLS data and published by Keith Byrd on his website www.SloCountyHomes.com.

The 457 total single-family sales through September is the highest 9-month total since 2006.

However, as the buying season winds to a close and families turn their attention to the holiday season, the local real estate market has slowed considerably. Higher prices, higher mortgage rates, and lower supply at affordable price points have burned the fire out of the market.

“Once August came, things just bottomed out,” said Vonderheide. “We have a flat line right now. There isn’t a ton of inventory, and there aren’t as many buyers.”

Vonderheide said that as of October 25, there were 102 single-family homes actively listed between $199,000 and $1,200,000 in the Paso Robles city limits. There were just 12 homes listed under $300,000 (which was the median just two years ago), and 29 homes listed between $301,000 and $450,000.

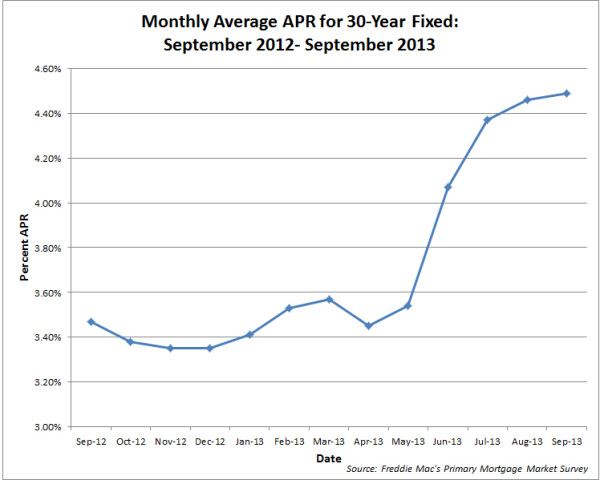

Mortgage rates have risen dramatically over the past year increasing house payments.

Higher mortgage rates and higher home prices have reduced what buyers can afford.

Jason Grote, owner of local mortgage lender Central Coast Lending, ran the numbers to illustrate this drop in affordability.

In February of 2013, a qualified buyer* could receive a 30-year fixed mortgage rate at 3.375% with an APR of 3.426%. At the time, the median sales price of a single-family Paso Robles home was $329,000.

Assuming a standard loan profile (listed at the end of this article), a buyer would average a monthly payment of $1,561.14.

Since then, a similarly priced 30-year fixed mortgage rate has jumped to 4.250% (4.252% APR), as the median price for a Paso Robles home rose to $369,000.

Using the same criteria, this brings the average monthly mortgage up to $1,898.09 – or $336.95 more per month.

Home prices have jumped for two primary reasons. First, the recovery came so fast that supply dropped quickly, and sellers have been slow to re-enter the market. With a larger number of buyers competing over fewer homes for sale, asking prices have trended up.

Second, fewer REO properties result in fewer bottom-barrel discounts.

Through the first nine months of 2013, just 8% of listings have been REO and 12% have been short sales. The 80% ratio of “normal” listings is the highest share since 2007.

These numbers mean that the market is returning to health, but also that prices will be higher.

Moving forward, Vonderheide sees more of the same.

“I think that the same pattern will continue as we approach the holiday season, which is typically slower for single-family purchases.”

Vonderheide added that the market outlook will also depend on rate movement. However, with the end of the Federal Reserve’s rate-juicing program Quantitative Easing (QE3) on the horizon, we don’t expect to see a return to the record-lows from late-2012 and early-2013. (Follow rate movement and the local real estate market on our website www.CentralCoastLending.com).

Ultimately, the supply crunch will ease as more sellers enter the market and adjust their asking prices to meet demand. The local real estate market is much closer to stability and health now than in 2011.

*Borrower profile: 750 credit score, 20% down payment, 30-year fixed loan with a 30-day lock, and full impounds. Occupant borrower required. Includes 1.25% property tax rate and 0.25% property insurance.

Comments

Scott Brennan is the publisher of this newspaper and founder of Access Publishing. Follow him on Twitter, LinkedIn, or follow his blog.