Legacy Retirement: How will this economic year do? Look to your calendar

-Promoted post-

It is easy to track – When each January is upon us, our focus is on what will the new year bring. Monitoring one month’s growth in the stock market is relatively easy to track. We get distracted with other events as the year progresses.

It occurs frequently – Since 1950, there have been 33 positive Januarys with a positive end of year.

This is not a bad indicator to use, however there have also been positive January’s since 1950 which ended in a negative year. This occurred four times in the years: 1962, 1974, 1981 & 2001. Therefore, the overall probability of a positive year with a positive January is 89.0%.

There is a better indicator than January alone.

it’s January AND February

(or the “Dual month Index” as we call it)

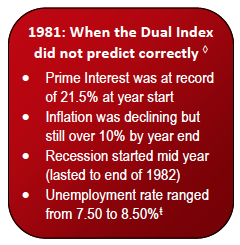

Whenever both January AND February have positive gains in the stock market, you are far more likely to have a positive year end. In fact, since 1950, this has occurred 24 times and only once (in 1981) did the year not end positive. This is a probability rate of 96.0%, an increase of 7.0% over using the January indicator alone. The average annual growth rate of the market during these 24 occurrences has been 16.12%.

But what happens when both months were negative?

A positive Dual Month Index (or Dual Index for short) is hard to achieve, but not as difficult as a negative Dual Index (both negative January and February) which has occurred only ten times since 1950.* However, regardless of its rarity, a negative Dual Index still leaves a 50/50 probability of a positive or negative year end. We believe this is why a positive Dual Index is more meaningful and should not be ignored when it occurs.

In conclusion, maybe we should adopt a new expression, “having a positive January is great, but for February we should wait.”

Sources:

https://www.quandl.com

Report data collected from 2011 Morningstar report (“Which will you believe: today’s news or 85 years of performance?”)

United State Misery Index

The authors of this article are investment & financial planners with Legacy Retirement Advisors. Learn more about the services they provide and how financial planning may benefit you by scheduling a no-cost consultation by calling (805) 226-0445 or schedule a meeting online by visiting www.LegacyCentralCoast.com.

Legacy Retirement Advisors

565 8th Street, Paso Robles Ca 93446

(805) 226-0445

(805) 226-8999

www.LegacyCentralCoast.com

Securities and advisory services offered through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Legacy Retirement Advisors and Independent Financial Group, LLC, are not affiliated. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties.

You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. Prepared by Legacy Retirement Advisors, Inc. © 2016