Local congressman comments on failure of Silicon Valley Bank

$200 billion bank failure is second largest in US history

$200 billion bank failure is second largest in US history

– Silicon Valley Bank, Santa Clara, California, was closed Friday by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank.

All insured depositors will have full access to their insured deposits no later than Monday morning, according to a news release from the FDIC. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

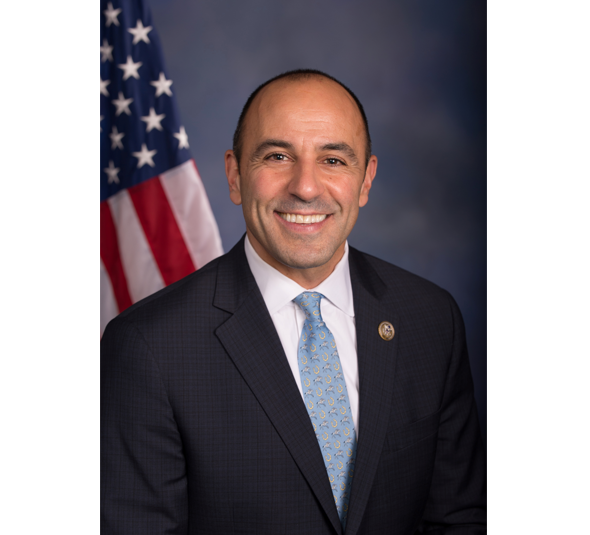

Congressman Jimmy Panetta

Congressman Jimmy Panetta (D), who represents Paso Robles and Monterey areas, released the following statement regarding the closure of the bank:

“I am extremely concerned by the sudden failure of Silicon Valley Bank and its impact on the technology entrepreneurs, innovators, and most importantly, workers, in my community. I am hopeful that a sale can be arranged to keep all depositors whole, but in the meantime, the FDIC must ensure that it provides clear updates to customers, both insured and uninsured, and do whatever it can to protect uninsured depositors from losses that could impact workers. Additionally, we must determine what caused the failure of Silicon Valley Bank, and how we can prevent future collapses.”

Silicon Valley Bank had 17 branches in California and Massachusetts. The main office and all branches of Silicon Valley Bank will reopen on Monday, March 13, 2023. The DINB will maintain Silicon Valley Bank’s normal business hours. Banking activities will resume no later than Monday, March 13, including online banking and other services. Silicon Valley Bank’s official checks will continue to clear. Under the Federal Deposit Insurance Act, the FDIC may create a DINB to ensure that customers have continued access to their insured funds.

As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined. The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.

Customers with accounts in excess of $250,000 should contact the FDIC toll–free at 1-866-799-0959.

The FDIC as receiver will retain all the assets from Silicon Valley Bank for later disposition. Loan customers should continue to make their payments as usual.

The failure of the bank is the second largest in US history, following the collapse of Washington Mutual Bank in 2008.

$200 billion bank failure is second largest in US history

$200 billion bank failure is second largest in US history